Debt Collectors: Profiting from Your Debt

Debt Collectors: Profiting from Your Debt is a thought-provoking documentary that sheds light on the lucrative industry of debt collection. This eye-opening film explores how debt collectors profit from the financial struggles of individuals and families.

The documentary delves into the tactics used by debt collectors to maximize their profits, often at the expense of vulnerable debtors. Through interviews with industry insiders and personal stories from those affected, viewers gain a deeper understanding of the impact of debt collection on individuals and society as a whole.

Watch the video below to get a glimpse into the world of debt collection and how it affects people's lives.

Debt collectors selling your debt

When it comes to debt collection, it's not uncommon for debt collectors to sell the debt they are pursuing to other companies. This practice, known as debt selling, can have significant implications for both the debtor and the creditor.

What is debt selling?

Debt selling is the process by which a debt collector transfers the rights to collect a debt to another company. This can happen for various reasons, such as when the original debt collector is unable to collect the debt or when they believe that selling the debt will be more profitable for them.

How does debt selling work?

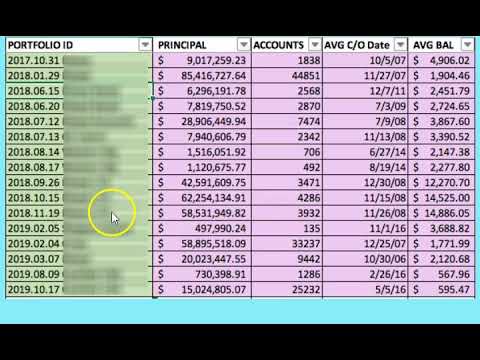

When a debt collector decides to sell a debt, they typically package it with other debts and sell it as a portfolio to a debt buying company. This company then becomes the new owner of the debt and assumes the responsibility of collecting it.

Why do debt collectors sell debt?

Debt collectors sell debt for a variety of reasons. One common reason is that they may not have the resources or expertise to effectively collect the debt themselves. By selling the debt, they can recover some of the money they are owed and transfer the responsibility of collection to a company that specializes in debt buying.

What happens when your debt is sold?

When your debt is sold, you will typically receive a notification from the original debt collector informing you of the transfer. The new debt owner will also send you a notification, providing you with information about how to make payments and contact them regarding the debt.

Implications for debtors

Debt selling can have several implications for debtors. One major implication is that the debt may be sold multiple times, resulting in frequent changes in the entity responsible for collecting the debt. This can lead to confusion for the debtor, as they may receive multiple notifications and communications from different companies.

Additionally, the new debt owner may have different collection practices and policies compared to the original debt collector. They may be more aggressive in their collection efforts or have different repayment options available. It's important for debtors to familiarize themselves with the new debt owner's policies to ensure they understand their rights and obligations.

Implications for creditors

For creditors, selling debt can be a way to recover some of the money owed to them. By selling the debt, they can receive a lump sum payment from the debt buying company, which can help improve their cash flow. However, selling debt also means that the creditor may receive less than the full amount owed, as debt buying companies typically purchase debts at a discounted price.

Additionally, creditors may lose control over the collection process once the debt is sold. The new debt owner may have different collection strategies and may prioritize certain debts over others. This can result in slower or less effective debt recovery for the creditor.

Conclusion

Debt collectors selling your debt is a common practice in the debt collection industry. While it can have implications for both debtors and creditors, it is important for individuals to understand their rights and obligations when their debt is sold. Debtors should familiarize themselves with the new debt owner's policies, while creditors should carefully consider the potential benefits and drawbacks of selling debt.

Debt Collectors: Profiting from Your Debt

This thought-provoking article sheds light on the controversial practices of debt collectors and their profit-driven approach towards individuals in debt. The author exposes the predatory tactics employed by these collectors, highlighting the negative impact on borrowers' financial well-being.

Through real-life examples and in-depth analysis, the article reveals the alarming reality of how debt collectors prioritize their own financial gain over helping individuals overcome their debt. It emphasizes the need for regulatory measures and consumer protection laws to curb these exploitative practices.

This eye-opening read serves as a reminder to stay informed and vigilant when dealing with debt collectors, advocating for fair treatment and responsible lending practices.

Leave a Reply